An Essential Guide to Financial IT Support Services Providers

November 4, 2025

Unlock digital excellence with expert computer hardware and networking services. Secure your business, boost productivity, and future-proof your IT.

February 11, 2026

Unlock predictable IT costs, always have the latest tech, and boost efficiency with Hardware as a Service. Transform your business today!

February 10, 2026

Find the best Remote IT Support Business for your small business. Learn how to define needs, evaluate providers, and secure your tech.

February 6, 2026

November 4, 2025

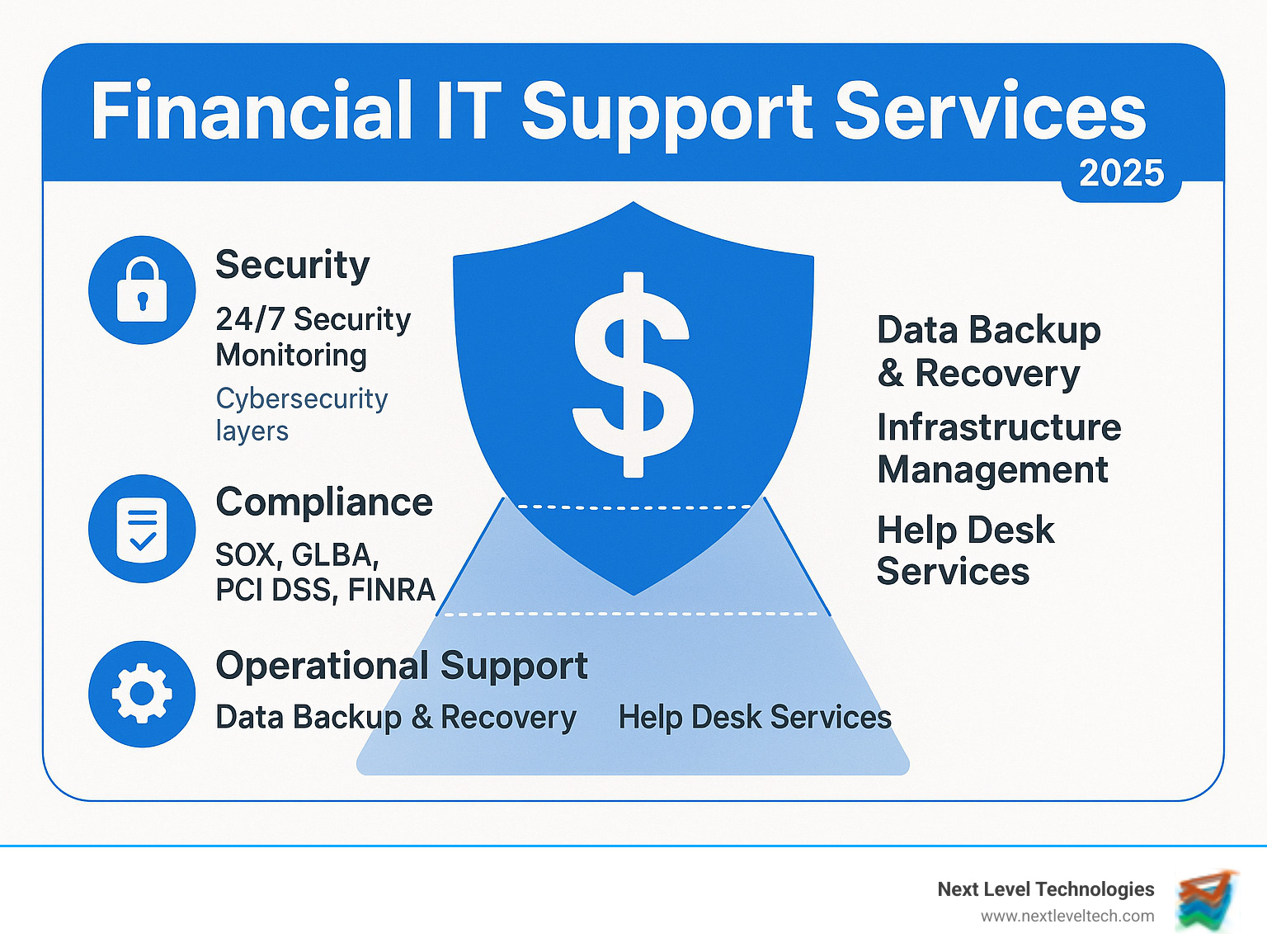

Financial IT Support Services are specialized technology solutions for the unique challenges facing banks, credit unions, and investment firms. These services cover cybersecurity, regulatory compliance, system monitoring, and disaster recovery, all custom to the financial sector's stringent requirements.

Key Financial IT Support Services include:

The stakes are incredibly high. The financial services industry experiences cyberattacks 300 times more frequently than other sectors, and unplanned downtime costs financial institutions approximately $500,000 per hour. These statistics show why generic IT support isn't enough.

Financial institutions face a perfect storm of sophisticated cyber threats, complex regulations, and the need to maintain customer trust while modernizing legacy systems. A single breach or violation can cause millions in fines, reputation damage, and lost customer confidence.

Specialized Financial IT Support Services are essential. Unlike general IT providers, they understand the unique workflows of financial institutions, from trading systems to data protection. They provide the expertise to steer regulations like Sarbanes-Oxley and GLBA while implementing cutting-edge security.

I'm Steve Payerle, President of Next Level Technologies, and I've spent over 15 years helping financial institutions in Columbus, Ohio and Charleston, WV strengthen their IT infrastructure and cybersecurity posture. My experience with Financial IT Support Services ranges from implementing SOC 2 compliance frameworks for credit unions to designing disaster recovery plans for regional banks.

Key terms for Financial IT Support Services:

Working with financial institutions in Columbus, Ohio, and Charleston, WV, I've seen the unique IT challenges they face. The combination of sensitive data, regulatory scrutiny, and 24/7 operations demands specialized expertise.

Cybersecurity threats are the most immediate and costly challenge. The statistics are sobering: the financial services industry experiences cyberattacks 300 times more frequently than other sectors. Your institution is constantly under attack from cybercriminals who see financial data as the ultimate prize.

Furthermore, data breach statistics show the financial sector faces the highest cybercrime costs. A single attack can expose customer records, trigger investigations, and destroy trust. Our team's extensive cybersecurity training confirms these are not random attacks but planned operations targeting specific vulnerabilities. Learn more in our guide to the Top 3 Cyber Threats Facing the Finance Industry.

Regulatory complexity is a growing challenge. Financial firms must steer a web of rules like FINRA, SOX, PCI DSS, and GDPR, each with its own technical requirements and penalties. Achieving compliance isn't about checking boxes; your IT infrastructure must be designed to support it with proper data retention, audit trails, and adaptability.

The cost of downtime has an immediate financial impact. When systems fail, the consequences are severe. Research shows that unplanned downtime costs financial institutions approximately $500,000 per hour, including lost revenue, regulatory penalties, and reputation damage.

Maintaining customer trust is also difficult, as clients expect both bank-level security and modern convenience. This is complicated by legacy system integration issues, where older critical systems struggle to meet modern security standards. Upgrading these systems without disruption requires careful planning and specialized expertise.

These interconnected challenges show why generic IT support is insufficient. Financial IT Support Services must address cybersecurity, compliance, uptime, and modernization simultaneously, requiring deep industry knowledge and proven technical experience.

For a financial institution, IT cannot be an afterthought. Financial IT Support Services must be proactive, not just reactive. Based on our work with banks and credit unions in Columbus, Ohio, and Charleston, WV, institutions need proactive monitoring, robust infrastructure maintenance, and fast, thorough troubleshooting.

More than just keeping systems running, financial IT is a strategic partnership in digital change. Whether migrating to the cloud or modernizing applications, your IT support must understand the impact on compliance and customer trust. Our team's extensive cybersecurity training and deep technical experience mean we're prepared for your critical systems. You can learn more about our comprehensive approach in our guide to Managed IT Services.

If you're in financial services, you're a target. Cybercriminals know that's where the money is, which is why the sector faces attacks 300 times more frequently than others.

This reality shapes our cybersecurity approach. We start with Managed Detection and Response (MDR), providing 24/7 threat hunting by security experts. Our staff's extensive cybersecurity training means we know what to look for and how to respond quickly.

Firewalls and endpoint protection are your first line of defense, but we also implement Multifactor Authentication Solutions because passwords alone are insufficient. Vulnerability scanning is another critical piece, as we regularly scan your network for weak spots.

Many IT providers overlook the human element, but employee security training is critical. We help your staff recognize phishing emails, handle data securely, and respond to suspected incidents. Our Cyber Security Services are designed to protect your data, reputation, and customers' trust.

If cybersecurity is a concern, regulatory compliance is a major challenge. The financial sector's web of regulations grows more complex annually, and a single misstep can lead to massive fines and lasting scrutiny.

We help you build systems and processes that make compliance part of your daily operations, making audit preparation less stressful. Data retention policies are critical, as regulations dictate how long to keep specific data and how to dispose of it. Errors can lead to serious penalties.

Our team has extensive experience with regulations like Financial Industry Regulatory Authority (FINRA), General Data Protection Regulation (GDPR), and Sarbanes-Oxley (SOX). We also assist with PCI DSS, GLBA, and SEC requirements. Our IT Compliance services ensure your technology supports these rules.

Our IT Compliance Monitoring services continuously monitor your compliance posture, alerting you to potential issues before they become violations. Our Cybersecurity Compliance Services integrate security and compliance into a unified approach.

Unplanned downtime costs financial institutions approximately $500,000 per hour. This includes not just lost revenue, but also regulatory penalties, customer defections, and long-term reputation damage.

Operational resilience is a fundamental requirement. Our Data Backup and Recovery solutions include comprehensive recovery strategies with failover systems and rapid response teams. Our teams combine technical expertise with extensive cybersecurity training to handle any incident.

We work with you to define realistic Recovery Time Objectives (RTO) and Recovery Point Objectives (RPO). Crucially, we don't just create and file these plans. Regular testing ensures your recovery procedures work during a real disaster, avoiding the critical flaws we've seen in untested plans.

Our Disaster Recovery Plan for Banks and Business Continuity IT Solutions help ensure your institution can weather any storm.

Choosing the right Financial IT Support Services provider is a critical decision that impacts your entire institution. Based on my 15 years of experience in Columbus, Ohio, and Charleston, WV, the right partner can be transformative, while the wrong one creates costly problems.

This is more than buying a service; it's a partnership to protect client data and ensure compliance. Look beyond marketing and focus on concrete Service Level Agreements (SLAs) that define response times, uptime, and performance metrics. These SLAs are your safety net. Implement comprehensive IT Vendor Risk Management Solutions as part of your evaluation. When exploring IT Outsourcing for Banks, you're extending your team—make sure they're worthy of that trust.

General IT knowledge is not the same as financial IT expertise. Your provider must understand the unique pressures and requirements of your industry. Look for a portfolio of financial clients similar to your institution's size and complexity.

Question their understanding of financial workflows, like the difference between ACH and wire transfers or the IT needs for trading systems. This is a basic competency for any expert in Financial IT Support Services. Request specific case studies and testimonials from similar institutions. Real success stories should be readily available.

Our experience providing IT Support for Accountants has taught us that financial professionals have unique needs, from specialized software support to understanding critical processing periods. This industry-specific knowledge is crucial when urgent issues arise.

With data breaches being so costly, your IT provider's security is critical. Their internal security must be as rigorous as the services they provide you. Examine their security stack, which should offer comprehensive 24/7 monitoring and a proven incident response protocol.

Look for relevant compliance certifications like ISO 27001 or SOC 2. These represent ongoing commitments to high security standards. Our team regularly undergoes IT Internal Audit processes to ensure we meet these standards.

The human element is equally crucial. Inquire about their staff expertise and demand evidence of extensive cybersecurity training. At Next Level Technologies, our technical team maintains current certifications in the latest security frameworks. Protecting your sensitive financial data requires continuous learning. Ask to speak with their security team to confirm their knowledge of IT Security for Banks.

Your institution will grow. Whether through expansion, mergers, or a growing client base, your IT support must scale with you. Seek providers with scalable solutions that adapt to your needs without a complete overhaul.

Cloud migration support is essential. Your provider should demonstrate expertise in Cloud Computing for Banks, helping you leverage the cloud while maintaining security and compliance.

A reliable 24/7 help desk is essential, but sometimes you need more. On-site support can be invaluable for complex issues. At Next Level Technologies, our local presence in Columbus, OH and Charleston, WV means we can provide rapid on-site response when you need it most.

Here are the key questions to ask when evaluating potential providers:

Over the years, we've had countless conversations with financial institutions exploring Financial IT Support Services. Here are the answers to the most common concerns we hear from firms in Columbus, OH, Charleston, WV, and beyond.

This is a common and smart question. The cost of Financial IT Support Services varies based on your firm's size, system complexity, required services, and the number of users and devices.

Most providers offer flexible pricing models, such as per-user fees, per-device fees, or tiered packages. For specialized operations, custom quotes often make the most sense.

Investing in specialized managed IT often delivers a strong ROI. Firms can save significantly on annual support costs compared to in-house management. You gain access to our team of experts, with their extensive cybersecurity training and financial industry experience, without the overhead of a full internal IT department. The predictable monthly costs also simplify budgeting. Learn more in our guide on What Can Managed IT Services Do For Your Business.

Disruption during a provider switch is a valid concern. A well-planned transition typically takes a few weeks to a few months, depending on your setup's complexity.

We start with a thorough IT assessment of your existing environment. From there, we develop a customized transition plan with a phased rollout. We migrate services gradually—starting with monitoring, then security, then data—to ensure your daily operations continue smoothly.

Minimizing disruption is our top priority. Our experienced technical team anticipates potential issues and plans around them. You can learn more about our approach in our IT Support overview.

This is a common concern. The short answer is no; we don't replace your IT team. We make them more effective through a co-managed IT model.

Think of us as an extension of your team. Your internal staff often handles routine tasks like password resets and software updates. By taking over these day-to-day items, we free your team to focus on strategic projects that drive business growth.

We excel at augmenting internal teams with specialized expertise access, particularly in advanced cybersecurity or financial compliance. Your existing staff gets to work on more strategic projects, and you get access to our entire team's knowledge—including our extensive cybersecurity training and financial industry experience—whenever you need it. This collaborative approach maximizes the value of both your internal and external resources.

The financial services world moves fast. With new technologies, changing regulations, and persistent cybercriminals, your institution faces immense challenges. The reality is that Financial IT Support Services are no longer just a business expense; they are the foundation that keeps your operations secure and your customers confident.

This guide covered the major challenges: cyberattacks hitting your industry 300 times more than others, downtime costing half a million dollars per hour, and a complex compliance landscape. These problems require more than generic IT support.

The summary of benefits from specialized financial IT support is clear: robust cybersecurity, proactive compliance management for FINRA, GDPR, and SOX, and reliable business continuity planning.

What truly matters is peace of mind. Partnering with experts who have extensive cybersecurity training and deep technical experience lets you focus on serving clients and growing your business, without worrying about data safety or compliance. This provides a real competitive advantage. While competitors deal with IT headaches, you're running smoothly, which customers notice.

Future-proofing your institution means partnering with people who understand where the financial industry is heading. Our team in Columbus, OH, and Charleston, WV, focuses on building systems that adapt and grow with your needs.

This isn't just about finding an IT vendor—it's about building a strategic partnership. The right partner becomes an extension of your team, protecting your reputation and your customers' trust. The investment in quality Financial IT Support Services pays for itself by avoiding the massive costs of data breaches, compliance violations, and downtime.

At Next Level Technologies, we are your partners in building a technology foundation that supports your success for years to come.

Ready to take your financial institution to the next level? Find how our comprehensive Managed IT Services and IT Support can transform your operations and give you the competitive edge you need in today's challenging market.

Unlock digital excellence with expert computer hardware and networking services. Secure your business, boost productivity, and future-proof your IT.

February 11, 2026

Unlock predictable IT costs, always have the latest tech, and boost efficiency with Hardware as a Service. Transform your business today!

February 10, 2026

Next Level Technologies was founded to provide a better alternative to traditional computer repair and ‘break/fix’ services. Headquartered in Columbus, Ohio since 2009, the company has been helping it’s clients transform their organizations through smart, efficient, and surprisingly cost-effective IT solutions.